does unemployment reduce tax refund

Congress hasnt passed a law offering. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax.

First the proposed change does not eliminate the need for amended returns.

. Scenarios like this are where GAR Disability Advocates can help workers receive the benefits they are entitled to. If You Have IRS Issues No Matter How Big Embarrassing Or Scary Our Tax Pros Can Help. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT Payment in Lieu of Notice When your employer continues to pay you after you stop working You cannot file until the last payment is received but the payments do not reduce your benefits Severance or Bonus Pay.

If youre married and filing jointly you can exclude up to 20400. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. A tax refund which occurs when a tax filer overpays their federal income taxes can be reduced to.

For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. Read on and watch this brief video to learn more about how these two types of benefits affect each other.

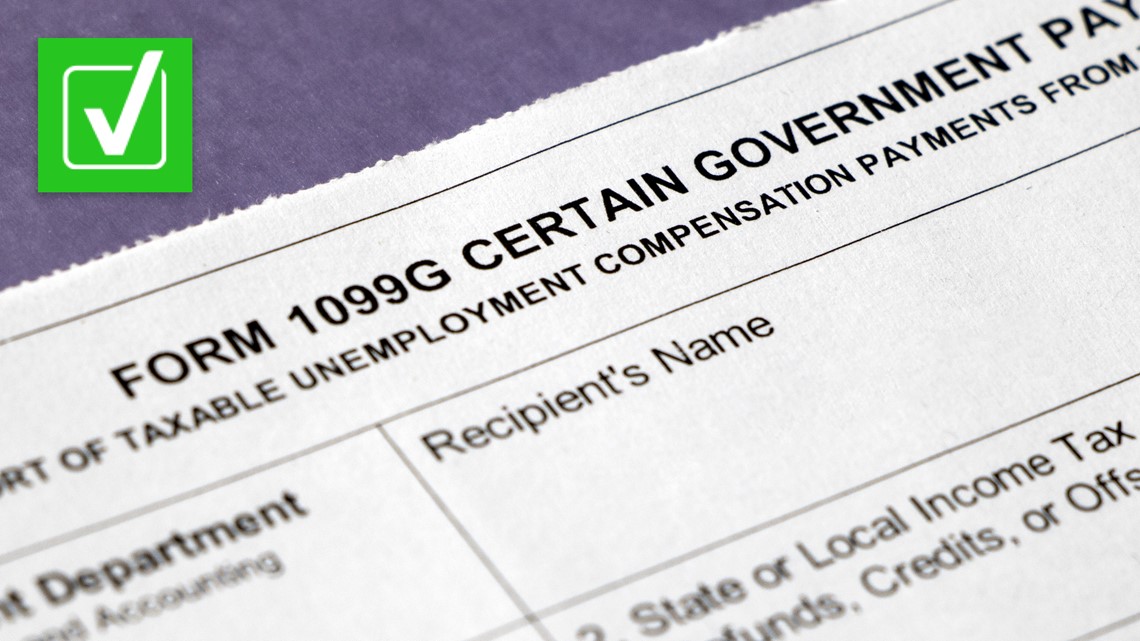

These outcomes seem unusual given that the stated intent of the new rules was to reduce the burden on taxpayers. If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in unemployment compensation from your income. 22 2022 Published 742 am.

Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income. While getting a big tax refund can feel like an exciting windfall the IRS doesnt want you to count on that money too soon. Ad Our Tax Pros Can Work With The IRS So You Dont Have To From Start To Solution.

Receiving unemployment benefits does not mean that a federal income tax refund will be reduced. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021 along with meeting certain other criteria. But for many jobless workers and their families those payments come with a catch.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. Why does my unemployment 1099-g lower my refund by 50. Unemployment Insurance UI benefits are taxable income but do not count as earnings.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. In the latest batch of refunds announced in November however the average was 1189. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income.

Line 7 is clearly labeled Unemployment compensation 3 The total amount from the Additional. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. One thing to keep in mind however is that SSDI and unemployment have a complicated relationship with each other.

They may result in smaller refunds from tax credits such as the earned income tax credit EITC next spring. Second the partnership may be burdened with two different Form 1042-S due dates for the same reporting year depending on when it makes a distribution. Because unemployment benefits are not considered earned income receiving unemployment rather than wages or salary may reduce.

You will need your social security number and the exact amount of the refund request as reported on your income tax return. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. If the amount of unemployment repayment is more than 3000 calculate the.

Tax Treatment of Unemployment Benefits. The IRS will automatically refund money to people who already filed their tax return reporting unemployment compensation or in some circumstances the IRS will apply the refund money to tax debts or. Dont bank everything on an incoming refund.

Heres everything you need to know about the IRS unemployment refunds including what to do if youve already filed your taxes. By Anuradha Garg. While it may be tempting to promise your tax refund to several time-sensitive bills or urgent needs remember that it can take up to 21 days for a tax refund to be delivered.

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

Federal agency non-tax debts.

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Unemployment Taxes Will You Owe The Irs Credit Com

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Why Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be Cnn Politics

8 Types Of Unemployment Understanding Each Type

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

An Independent Contractor Is A Person Or Entity That Contracts With Another To Perform A Particular Task Business Tax Independent Contractor Education Poster

30 Free Employee Verification Form Template Effect Template

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

How Does Unemployment Insurance Work And How Is It Changing During The Coronavirus Pandemic

14 Proof Of Income Letter For Pdf Word Doc Check More At Http Moussyusa Com Proof Of Income Letter Peace Of Mind Lettering Words

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

/unemployment-5bfc344bc9e77c00519c4b43.jpg)

How The Unemployment Rate Affects Everybody

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return